puerto rico tax incentives act 20

Act 60 of 2019 known as the Puerto Rico Incentives Code was enacted to consolidate into one single act and simplify all incentives available for individuals and. On January 17 2012 Puerto Rico enacted Act No.

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

Act 20 aka the Export Services Act specifically provides massive tax advantages to qualifying service businesses.

. On January 17 2012 Puerto Rico enacted Act No. On July 11 2017 Governor Ricardo Roselló signed into law amendments to Act 20-2012 Act to Promote the Export of Services Act 22-2012 Act to Promote the Relocation of. With the arrival of several figures led by Brock Pierce following the passing of hurricane Maria in 2017 cryptocurrency became an issue of media and economic interest in the Caribbean.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. Under this new law known as the Incentives Code Acts. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS.

Puerto Rico Corporations who qualify for the Act 20 tax. Puerto Rico enjoys fiscal autonomy. Act 20 Puerto Rico Tax Incentives.

100 Tax Exemption on Income Tax Rate from dividends or profit. 4 Fixed Income Tax Rate on Income related to export of services or goods. Act 20 now Chapter 3 of the Puerto Rico Incentives Code 60 allows eligible businesses to benefit from a multitude of tax incentives provided by the Puerto Rican.

Make Puerto Rico Your New Home. Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. Puerto Rico Incentives Code 60 for prior Acts 2020.

Purpose of Puerto Rico Incentives Code Act 60. Many high-net worth Taxpayers are understandably upset about the massive US. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for.

20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a. Taxes levied on their employment investment. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors.

Puerto Rico Municipal Taxes Torres Cpa

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Forbes Puerto Rico Bids To Become New Age Tax Haven

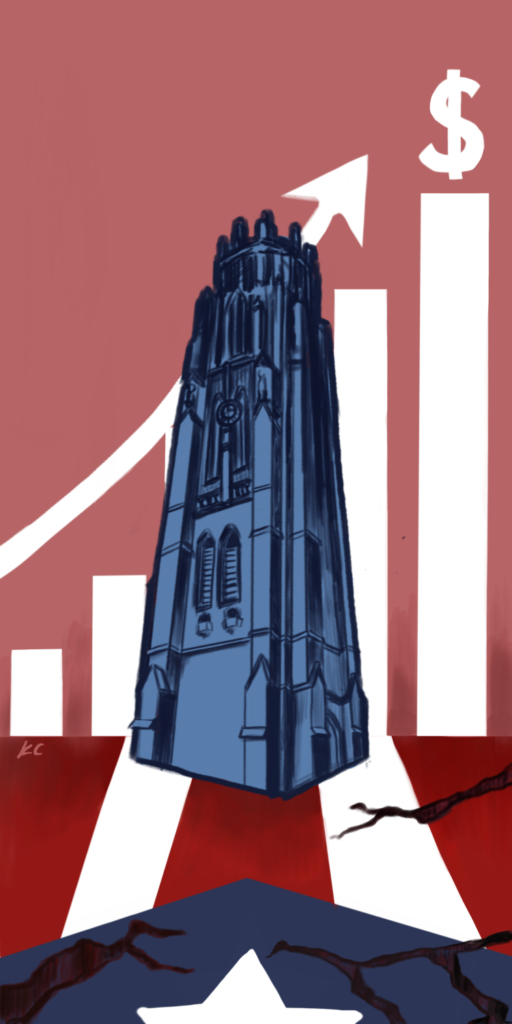

Yale And The Puerto Rican Debt Crisis Yale Daily News

Moving To Puerto Rico From The Usa Movebuddha

A Tax Haven Called Puerto Rico Eyes On The Ties

Santurce Your Puerto Rico Real Estate Neighborhood Guide Relocate To Puerto Rico With Act 60 20 22

Moving To Puerto Rico Including Job Opportunities Taxes Southern Self Storage Blog

Pr Relocation Guidebook Short Relocate To Puerto Rico With Act 60 20 22

Financial Incentives For Puerto Rico Residents

A Tax Haven Called Puerto Rico Eyes On The Ties

Puerto Rico Woos Rich With Hefty Tax Breaks Marketwatch

American Abroad Federal Puerto Rico Act 20 22 Torres Cpa

Puerto Rico 39 S Act 20 And Act 22 Key Tax Benefits Insights Dla Piper Global Law Firm Law Firm Insight Puerto Rico

A Global Americans Review Of Boom And Bust In Puerto Rico How Politics Destroyed An Economic Miracle

Puerto Rico Tax Incentives Pellot Gonzalez

Puerto Rico Google Images Caribbean Getaways Places To Visit Places To Go

Overview Relocate And Move To Puerto Rico With Act 20 Act 22